Boutique Investment Banking Technology Benchmarking

Over 70 questions covering 30+ capabilities

With over 70 questions, covering 30+ capabilities, ranging from your basic PC/laptop computer to the latest AI tools, our survey provides the most comprehensive assessment of how boutique investment banks should be leveraging technology to their advantage, to drive business deals.

Plain English descriptions

We understand that technology can seem complicated and as if it has its own language, to many people. Our bespoke survey ensures that every question comes with plain, non-technology descriptions of each capability, to help your business users understand how technology can benefit your bankers and what they can expect from technology services.

Easy-to-use tool

Whether you are looking to understand how your bankers view your current technology capabilities, how they benchmark your technology services against your peers or simply generate some new ideas about what great technology could (or should) be doing for you, our custom built survey tool is designed especially for bankers, to quickly and easily provide feedback either from a mobile (ie iPhone), tablet( ie iPad) or PC (laptop) device.

Over 70 questions covering 30+ capabilities

With over 70 questions covering 30+ capabilities, ranging from your basic PC/laptop computer, to the latest AI tools, our survey provides the most comprehensive assessment of how boutique investment banks should be leveraging technology to their advantage, to drive business deals.

Covered Topics Include:

- Infrastructure

- End User Devices (PC/Laptops /Tablet etc.)

- Office Employee Wifi/Network Services

- Communication (Phones, Email, Chat, Messaging)

- Remote Connectivity (VPN)

- Service Management (Helpdesk, Requests, Availability)

- Information Security

- Identity & Access Management (IAM)

- Office Building & Area Access

- Data Loss Prevention (DLP)

- Security Information & Event Management (SEIM)

- Data Storage Encryption (EKM/CKM)

- Banking Management

- Customer Relationship Management (CRM)

- Deal Pipeline & Revenue Management

- Industry Fees and League Table Analysis

- Banker Enablement

- Pitch Deck/Presentation Branding & Reusable Content

- Document Sharing & Collaboration

- Company & Industry Research

- Knowledge Management & Information Sharing

- Data Analysis and Financial Modelling

- Data Science, AI, NLP, and Automation

- Client Enablement

- Client Portal

- Document Sharing and Collaboration

- Client Collaboration

- Client Preferences and Interests

- Online Data Analysis and Analytics Collaboration

- Online (Video) Meeting Collaboration

- Business Development & Audience Engagement

- Audience Analytics and Targeting

- Corporate Website

- Deal Announcements & Email Push Marketing

- Social Media Marketing & Listening

- Meeting & Events Management

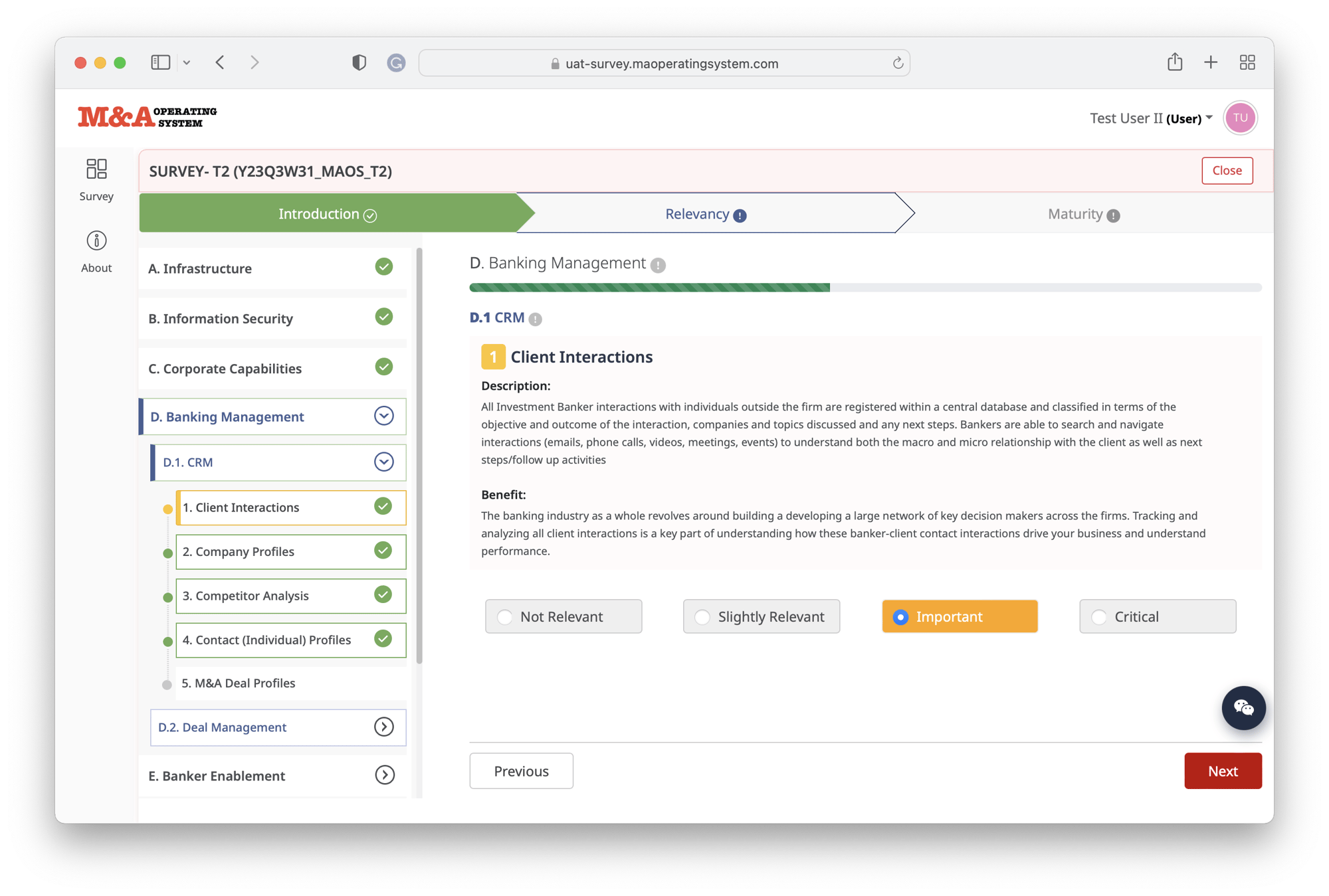

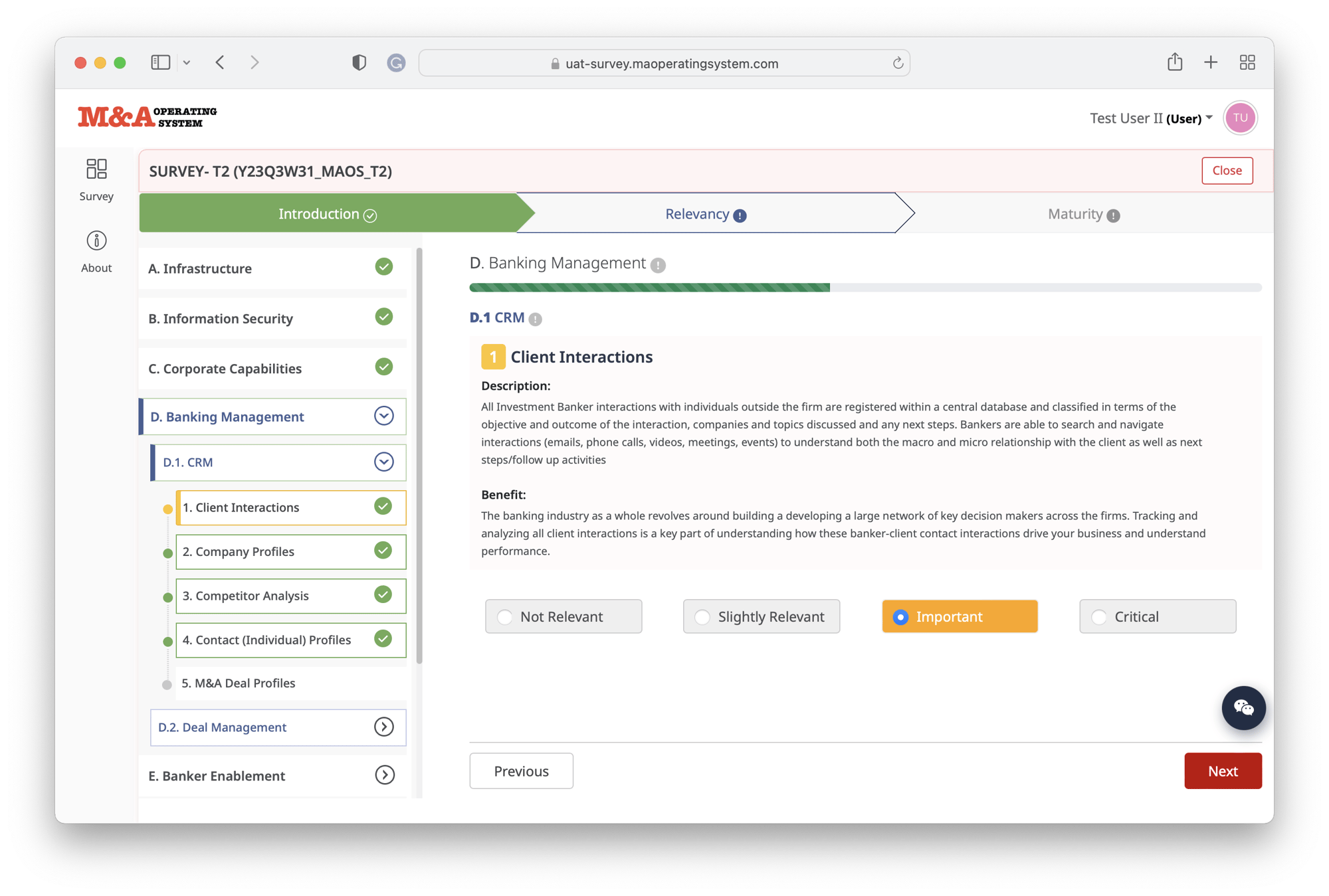

Plain English descriptions

Plain English descriptions of each technology capability, help bankers to understand what they should be expecting from technology and express how importantly they view this.

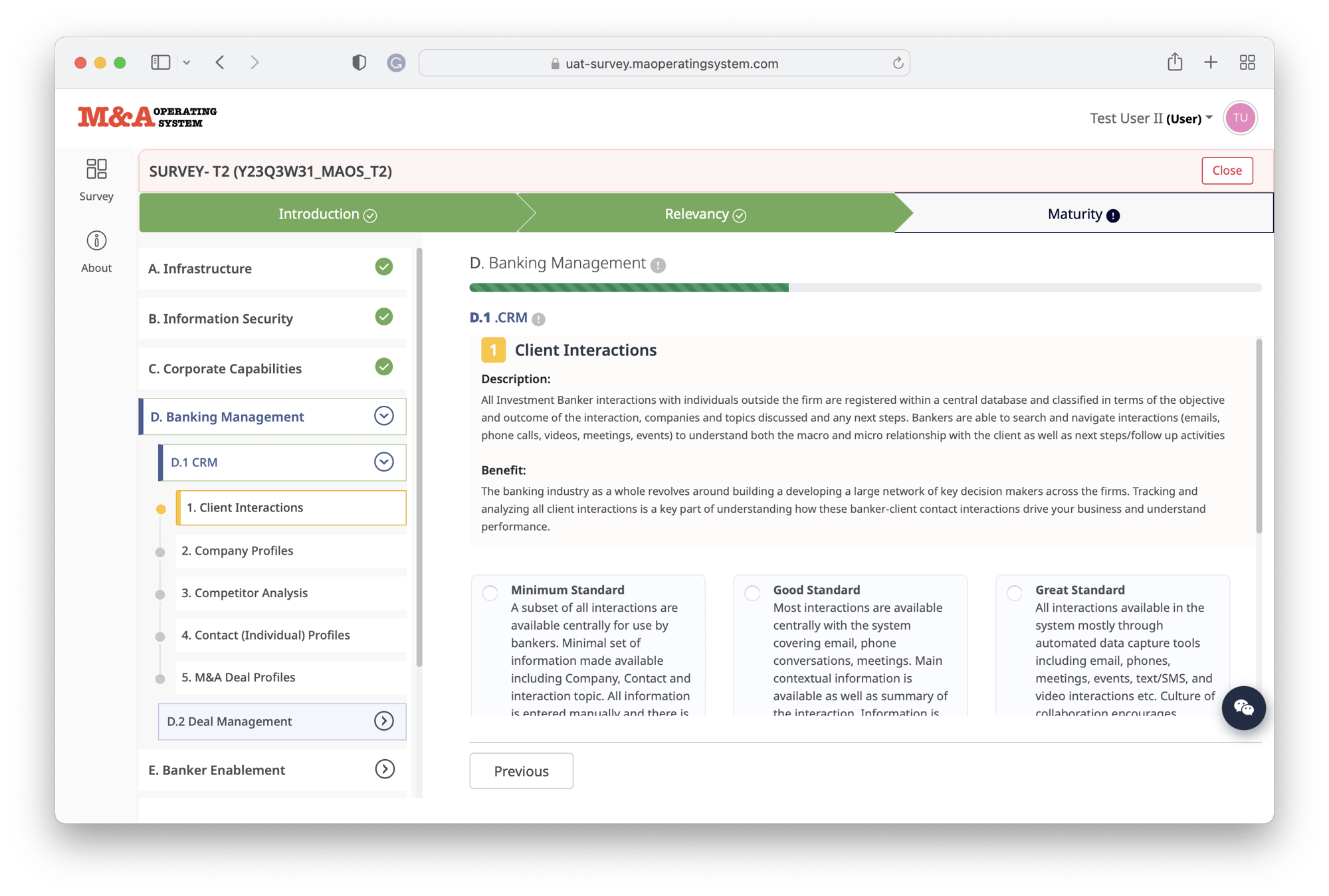

Informative maturity descriptions

Each capability also comes with easy-to-understand maturity descriptions, which help non-technologists assess their current technology capabilities, against a standardized set of outcomes.